Tabby UAE: A Comprehensive Guide To The Tabby App

You’re browsing online and have just spotted the perfect pair of sneakers that you have been waiting to buy for a long time, or it could even be that Oculus VR headset that you have been dreaming about. You add it to your cart, and suddenly reality sets in…your bank account isn’t quite as willing as you are. But what if there is an app that lets you buy what you love now, AND pay for it later, without any of the stress attached with buying high-end purchases? Well, Tabby is the answer to smarter shopping.

What’s Tabby?

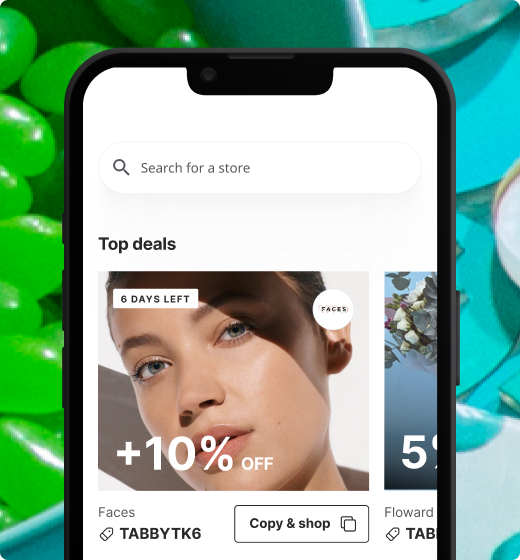

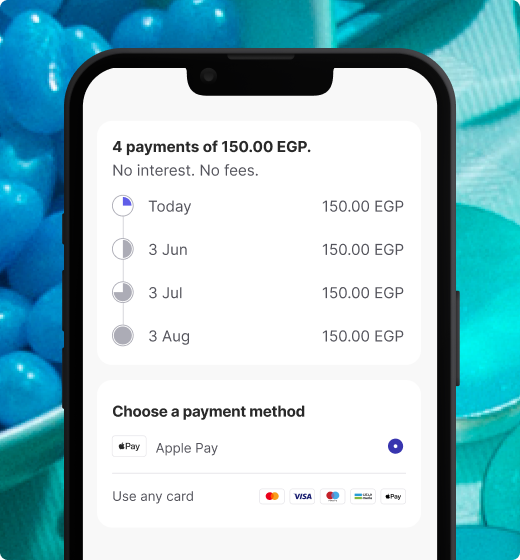

Tabby is not just another shopping app, but infact it’s your new best friend in the world of retail therapy. Created in 2019 and launched in the UAE and Saudi Arabia, Tabby is a “Buy Now, Pay Later” (BNPL) service that allows you to split your purchases into four interest-free installments. Yup, you heard that right…no interest, no hidden fees, just shop till you drop!

Here’s how it works. When you’re done shopping and are about to check out, choose Tabby as your payment option. You’ll pay just 25% of the total upfront, and the remaining balance will be spread out over the next three months. You can also use Tabby at physical stores by getting the Tabby card, allowing you to pay at Tabby-partnered stores as well as any store that accepts VISA payments (if you have activated Tabby+).

Tabby – Best Thing Since Sliced Bread?

Shopping in the UAE can be an expensive affair, especially when you’ve got those high-end gadgets, gaming consoles or extravagant accessories in your sights, and that’s the truth. But when you’ve got Tabby, you don’t have to keep saving up enough cash, which is precisely why Tabby is quickly becoming a favorite among frequent shoppers.

Here are some of the benefits of using Tabby:

- Freedom & Flexibility

Tabby allows you to shop without sweating about payments immediately. You can easily purchase any item today and spread the cost over four months, making it easier on your wallet.

- Interest-free

Credit cards or traditional loans charge interest. Tabby doesn’t. This means no hidden fees, no extra costs, just straightforward, transparent payments. Simple.

- Safe & Secure

Shop with confidence knowing that your transactions are protected by cutting-edge industry security protocols and, if you’re not happy with your purchase, you may return it and your refund will be processed directly via the Tabby app.

- Choices Galore

Whether you’re into fashion, electronics, home décor, or beauty products, Tabby has partnered with a wide range of retailers to ensure there’s something for everyone. From global brands like Adidas and IKEA to local favorites, Tabby makes shopping a seamless experience.

- Easy Peasy

Tabby is a user friendly app which makes managing your payments very simple. You can browse your favorite stores, make purchases, and keep track of your installments as a one-window solution, with just a few taps.

A Step-by-Step Guide To Using Tabby App

Using Tabby is even if you’re new to the world of BNPL apps. Here’s a quick guide to get you started:

- Download the Tabby App

Obviously, the first step is downloading the Tabby app from the App Store or Google Play. It’s free and barely takes a minute.

- Signing-Up

Create an account using your ID and a valid debit or credit card issued by a UAE bank. You may be asked to provide additional documents for verification, but the process is usually quick and hassle-free.

- Shop Till You Drop

Browse through Tabby’s extensive list of partner stores and add your favorite items to your cart.

- Choose Tabby at Checkout

When you’re done shopping and are ready to make a purchase, select Tabby as your payment method. You’ll be asked to confirm your mobile number and email, and you’ll receive a 4-digit verification code to complete the process.

- Pay ONLY 25% Upfront

At the time of purchase, you’ll only need to pay 25% of the total amount. The remaining balance will be split into three equal monthly installments.

- Enjoy!

Now that your payment plan is set, you’re all done! Your order will be processed, and your items will be on their way. Congratulations!

What If You Miss a Payment?

Sometimes things don’t go according to plan. That’s life, it happens. But worry not as Tabby’s got your back. If you miss a payment, here’s what you need to keep in mind:

- Payment Reminders

Tabby will send you regular reminders before your payment is due, helping you stay on top of your installments.

- Service Suspension

Let’s say you missed a payment, Tabby’s service will be temporarily suspended until the outstanding amount is paid. This is just to ensure that payments are made responsibly and on time.

- Collection Fee

In the event of a missed payment, a small collection fee will be applied. This fee is designed to cover the cost of processing the missed payment and to encourage timely payments.

- Contact Tabby

If you’re having trouble making a payment, it’s always a good idea to contact Tabby’s customer service team as they’re always there to help you find a solution and get back on track.

How Big A Footprint Has Tabby Left on Shopping?

Since its launch, Tabby has had a significant impact on the retail landscape in the UAE and beyond. By offering a flexible, interest-free payment option, Tabby is helping shoppers make smarter financial decisions. Whether you’re buying a new gaming console, updating your laptop, or looking for an anniversary present for your significant other, Tabby makes it easy to shop without the stress.

But Tabby’s influence isn’t limited to just the consumers, even retailers are benefiting with massive sales and a new and increasing customer base. Businesses are offering a more attractive payment option, turning browsers into buyers and expanding their customer base by simply joining hands with Tabby.

Why Tabby is Here to Stay

The Buy Now, Pay Later trend is more than just a fad…it’s a reflection of the changing needs and preferences of modern consumers. In today’s world, where convenience and financial flexibility never been more crucial, Tabby is perfectly positioned to thrive.

As more and more people discover the benefits of BNPL, Tabby is set to become a staple in the shopping habits of consumers across the Gulf and beyond. With its user-friendly app, safe & secure payment plans, and an extensive list of partners, Tabby is not just a payment option, it’s a smarter way to shop.

Try Tabby Today

If you’re someone who loves to shop but hates the stress of upfront payments, Tabby is THE app for you. With its flexible payment plans, zero interest, and a huge list of partner stores, Tabby makes it easy to get what you want, when you want it, without breaking the bank. Also, what’s better than you earning cash while shopping now and paying later? It is also backed by a Saudi Central Bank permit, is Shariah compliant AND has a PCI-DSS certification.

Picking the right payment partner in the UAE is crucial for your ecommerce website’s requirements and budget. A skilled e-commerce website development agency can seamlessly integrate this secure payment gateway, letting both merchants and customers experience ease and complete confidence while doing business on your site.

So, why not give it a try? Download the Tabby app today, start shopping smarter, and see for yourself why it’s quickly becoming a favorite among savvy shoppers in the UAE and beyond.